2. Maximum Borrowing Calculations (MBC)

When you have set up a new case, the next step is doing a Maximum Borrowing Calculation (MBC). This simple guide will help you do it with ease.

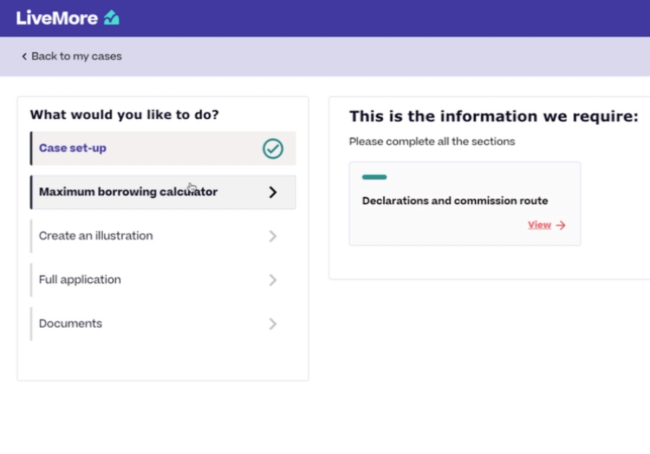

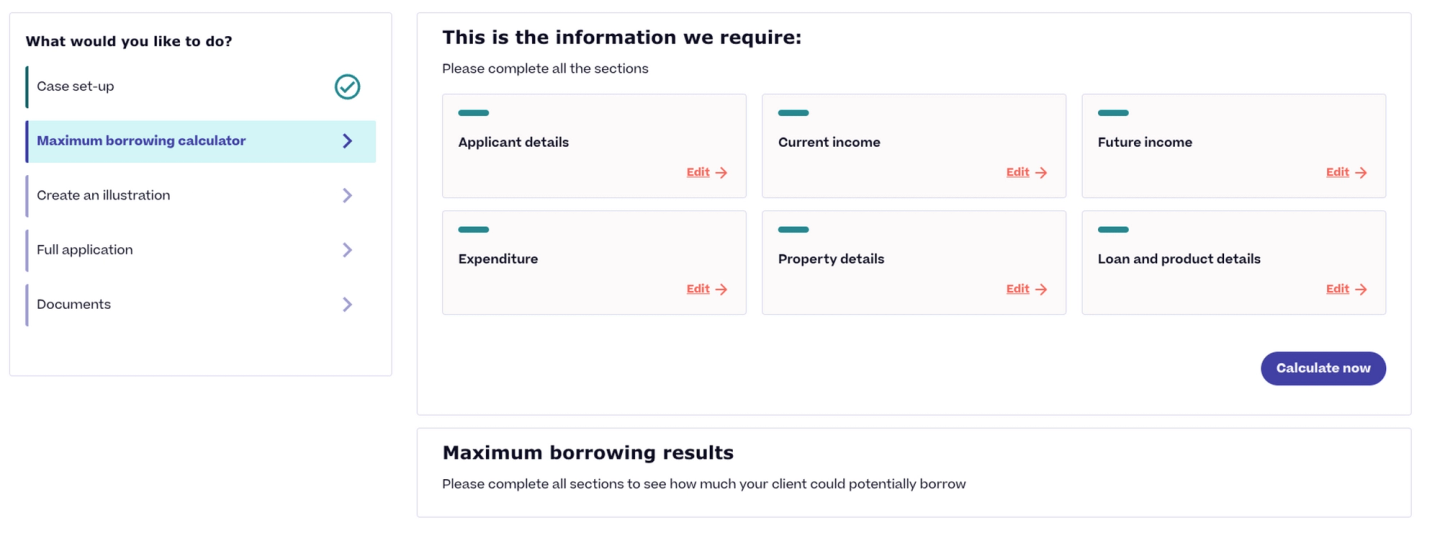

To start your MBC, open your case and select MBC from the left dropdown.

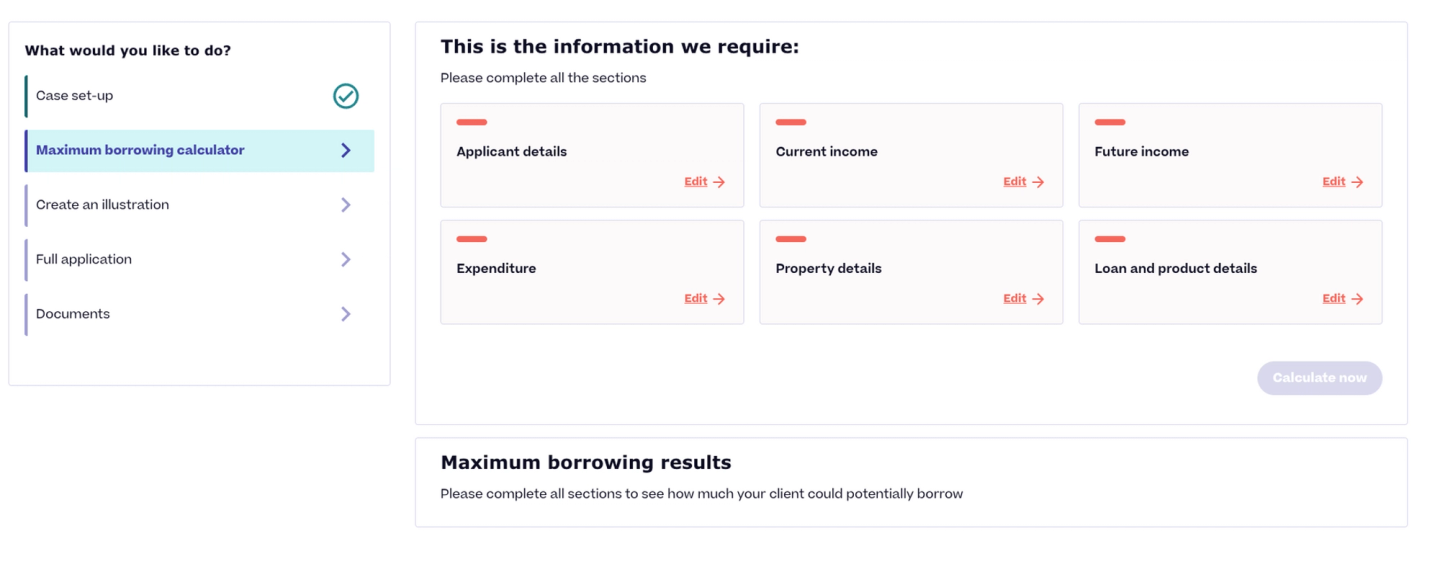

You will then see a summary of all the information we require. There are 6 brief sections to fill out:

- Applicant details

- Current income

- Future income

- Expenditure

- Property details

- Loan and product details

You will see each section has a red ‘pill’ in the top left corner. As you fill each section, these will turn green. When all are green, you will be able to submit your MBC.

Also, in future sections of your case, if any of the information you enter is needed again, it will be pre-populated, so you don’t have to enter it more than once.

Let’s take each section in turn.

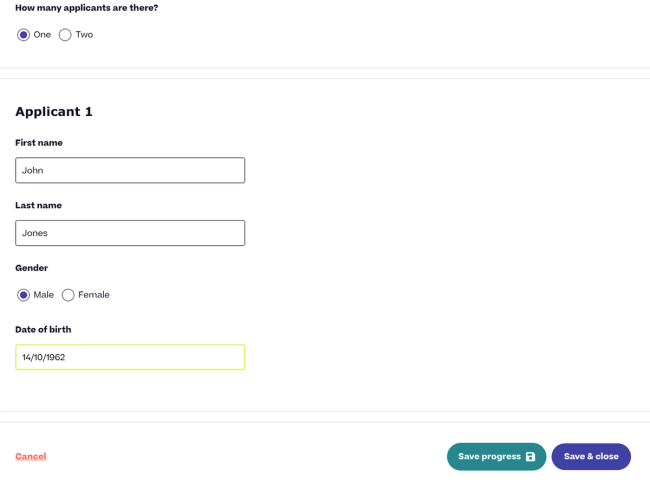

1. Applicant details

Provide the following details for your applicant:

- First name

- Last name

- Gender

- Date of birth

When ready, click ‘Save & close’.

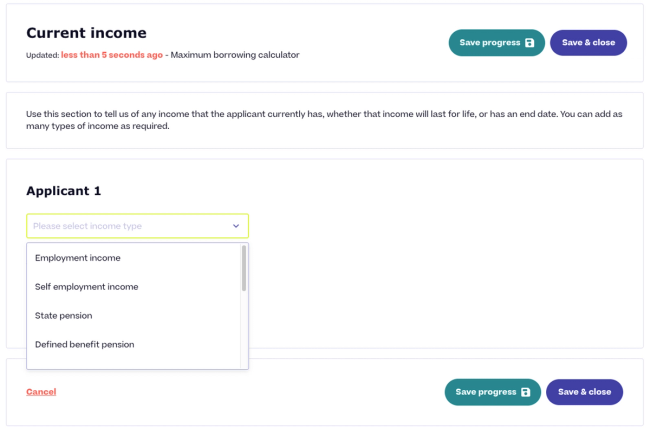

2. Current income

Click ‘add income’ to tell us of any incomes your client has (or tick the box if there is no current income). If applicable, repeat for each applicant.

When ready, click ‘Save & close’.

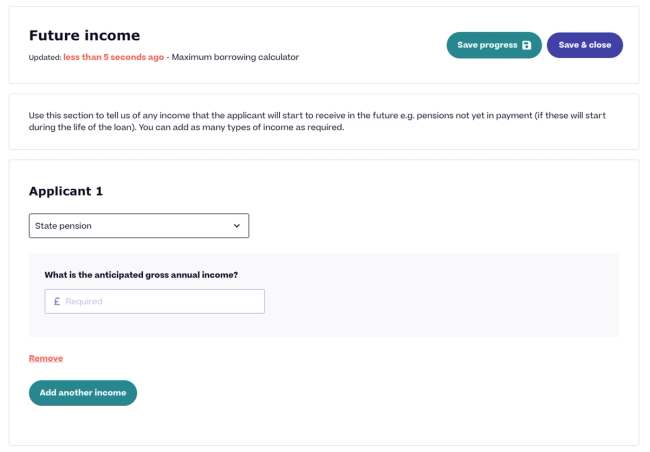

3. Future income

This is where you tell us of any income that your applicant will start to receive in future, such as pensions not yet in payment (if they will start during the life of the loan).

Add as many as you need, then click ‘Save & close’.

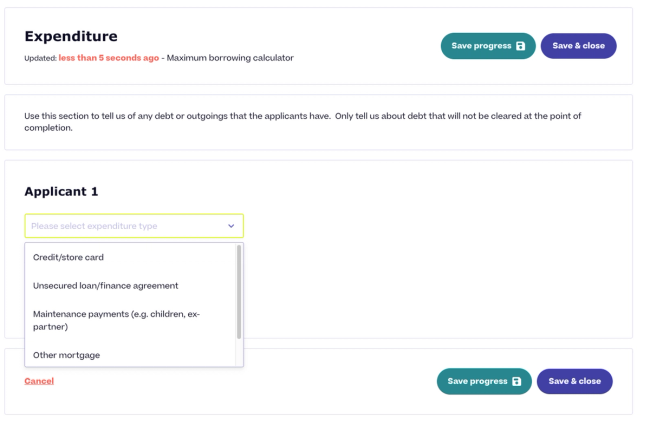

4. Expenditure

This is where you will tell us of any outgoings or debt.

You only need to tell us about debt that won’t be cleared at the point of completion, as this is what we need for the affordability calculation. You can tell us about debt that your client will be clearing at DIP or full application stage.

Add all necessary expenditure (or click no expenditure) and then click ‘Save & close’.

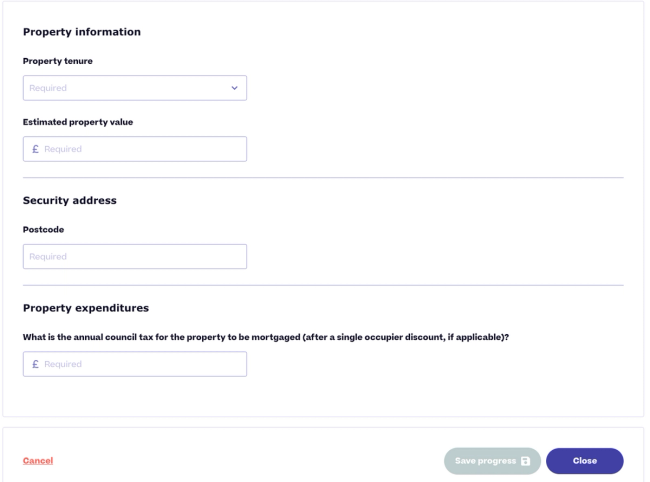

5. Property details

This is where you tell us the relevant information about the property, including:

- The tenure (freehold, leasehold etc)

- Property value

- Security address postcode

- Council tax for the property

When ready, click ‘Save & close’.

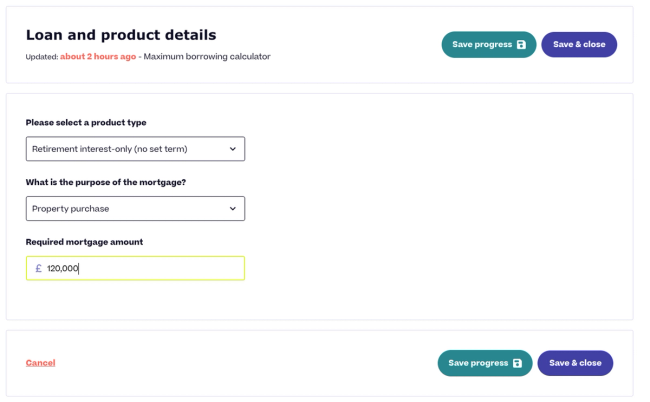

6. Loan and product details

This is where you tell us the key information about the application including:

- Product type

- Repayment type

- Mortgage term required

- Purpose of the mortgage (property purchase, remortgage etc)

- The required mortgage amount

When ready, click ‘Save & close’.

That’s it! Your section ‘pills’ should now all be green. If so, select ‘calculate now’.

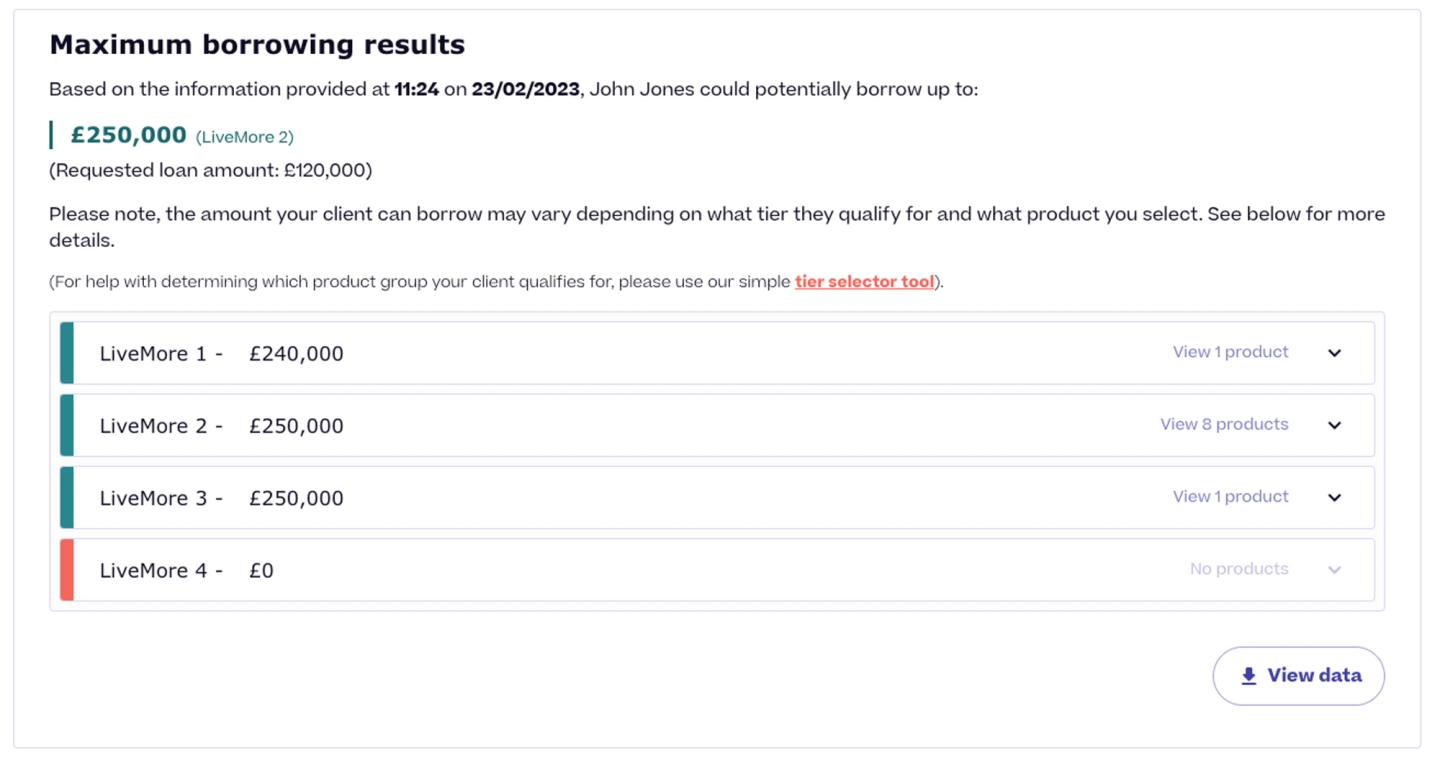

You will then be able to scroll down to see your MBC results. This will include a headline figure, with a breakdown of your maximum borrowing amount by tier and by product.

This information is then easily downloadable to send to your client.