4. Submitting a Full Mortgage Application (FMA)

It’s now time to submit your client’s full application. Follow the simple steps below to submit one quickly and correctly.

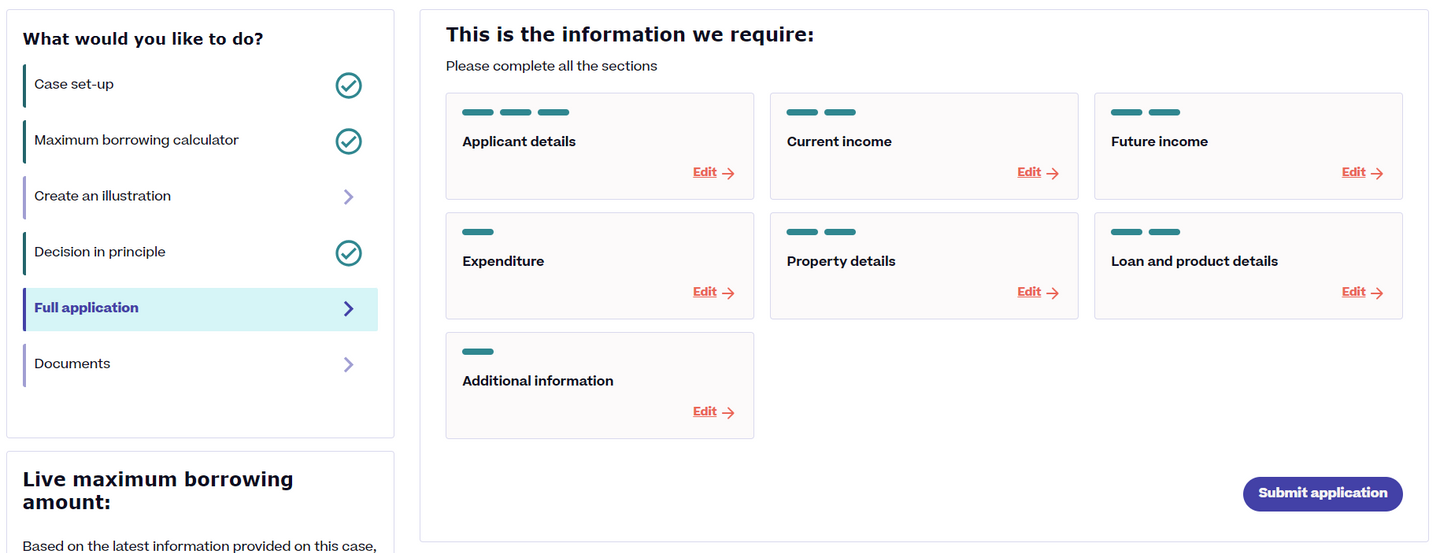

With the DIP now complete, the ‘Full application’ option is now unlocked on the left hand menu.

You will then see a summary of all the information we require. There are 8 brief sections to fill out, some of which are already complete (or partially complete) from your previous steps:

- Applicant details

- Current income

- Future income

- Expenditure

- Property details

- Loan and product details

- Repayment strategy (for Standard Interest Only cases only)

- Additional information

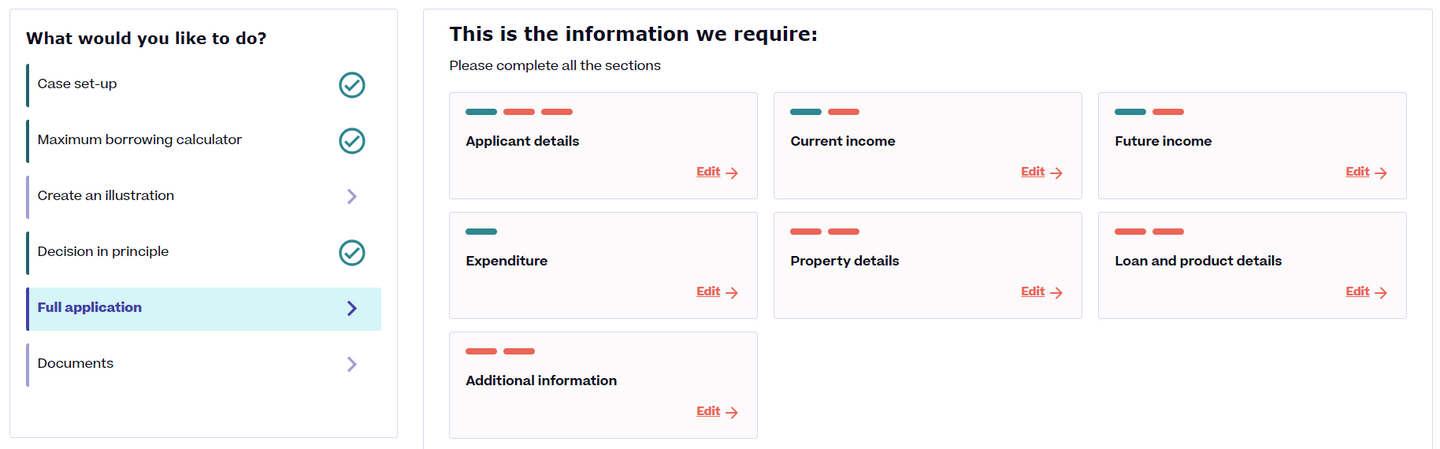

You will see each section has a red ‘pill(s)’ in the top left corner. As you fill each section, these will turn green. Note that some sections will already be partially green due to the information filled out in previous steps.

When all green, you will be able to submit your client’s full application.